-

SOCIAL SECURITY STRATEGIES

-

FOR RETIREES WITH $500K+ IN ASSETS

- How the Right Timing Could Help You Maximize Benefits — and Minimize Regret

Bucket Planning

Helping Empower you to retire on your terms

- Keeping up with financial news these days can be unnerving, especially if you’re close to or entering retirement.

-

There’s so much uncertainty and change in the economy right now, and sudden market declines are reflecting that. This economic environment, and the media coverage of it, can be scary, but this is the type of situation bucket planning is designed for.

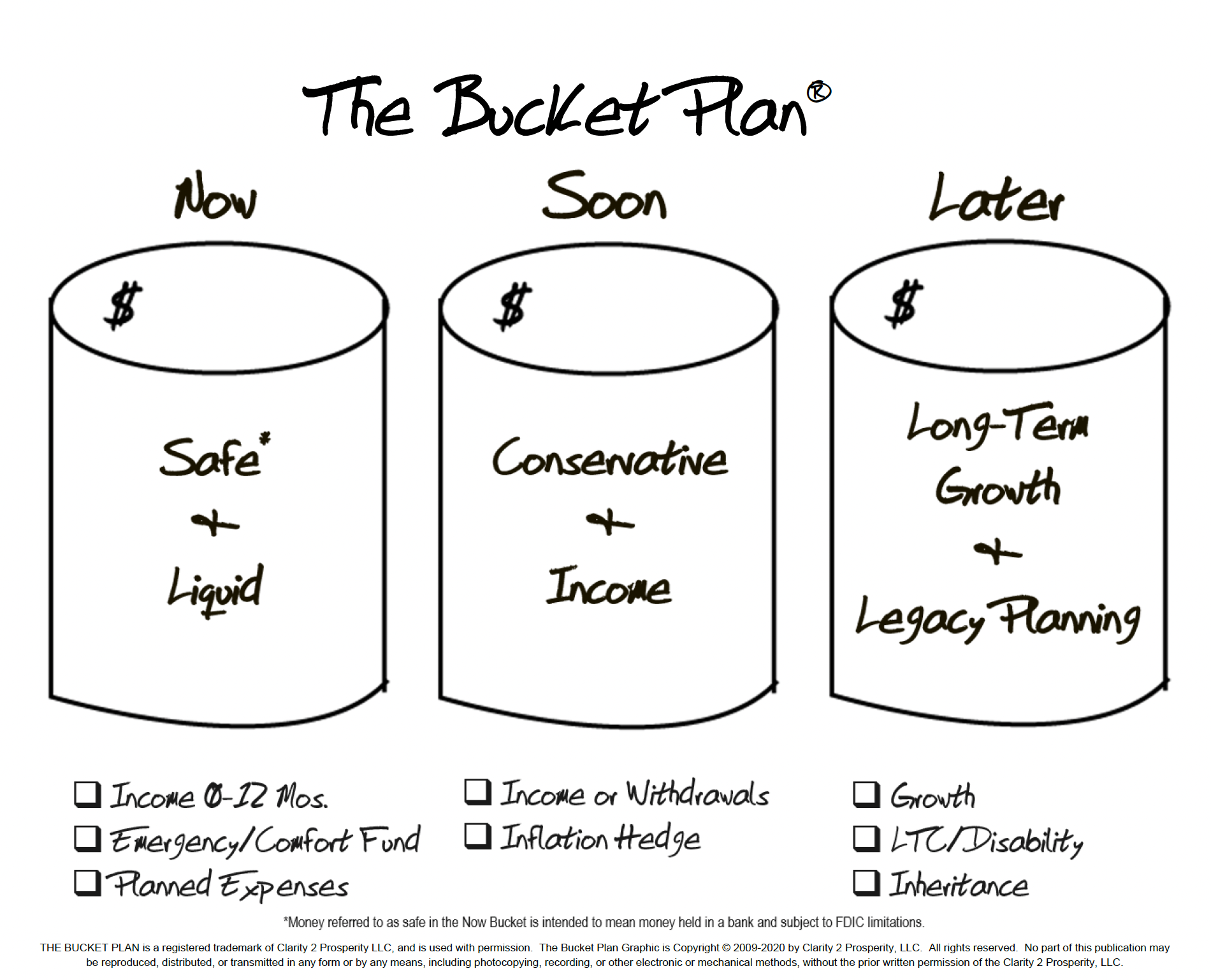

One of the biggest challenges in retirement is ensuring that your savings last throughout your lifetime, especially during periods of market volatility. Bucket Planning is a structured strategy that helps retirees allocate assets based on short-term, mid-term, and long-term retirement needs, ensuring a balance between liquidity, income stability, and growth potential.

strategy that works

The Bucket Plan

The Bucket Plan is a time-tested strategy that simplifies retirement planning by time-segmenting your wealth into three essential buckets.

This approach ensures you have the resources you need when you need them while maintaining a balance between immediate access and long-term financial stability.

Explore Bucket Planning for Your retirement Strategy

Learn how strategic asset allocation can help manage financial security through different market conditions.

Disclaimer

Investment advisory services are offered through Foundations Investment Advisors, LLC (“Foundations”), an SEC registered investment adviser. Nothing on this website constitutes investment, legal or tax advice. Any historical performance data is solely illustrative and provided as general information and is not a prediction of any future results or any past results for any specific client of Foundations. This website and its contents do not make any recommendation that any particular security, portfolio of securities, transaction, investment, or planning strategy is suitable for any specific person. Personalized investment advice can only be rendered after the engagement of Foundations, execution of required documentation (including a client agreement), and receipt of required disclosures. Investments in securities involve the risk of loss, including a total loss of money invested. Any past performance is no guarantee of future results. Advisory services are only offered to clients or prospective clients where Foundations and its advisors are properly licensed or exempt from licensure; Foundations reserves the right to accept or reject any prospective client. For more information about us, please go to https://adviserinfo.sec.gov and search by our firm name or by our CRD #175083